Table of Contents

DeFi - Introduction to Liquidity Pools

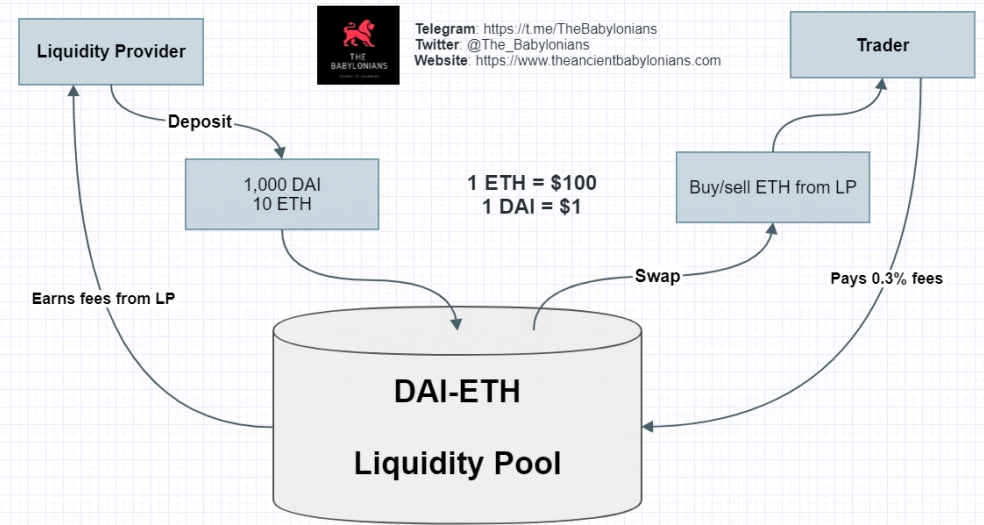

Liquidity pools are crucial for peer-to-peer trading in DeFi. Liquidity is the ability of an asset to be sold or exchanged quickly and without affecting the price. In other words, liquidity is a measure of how easily an asset can be converted.

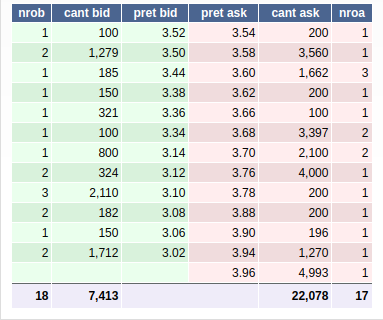

Traditional exchanges use order books:

Q: What if I want to buy/sell large amounts?

Problem 1: Price moves for several levels.

Problem 2: There may not be enough liquidity.

Why are liquidity pools useful?

- enable users to trade on DEXs

- eliminate middlemen and centralized entities

- Liquidity providers get incentives

Liquidity Providers

Go to Devnet Wallet and use the Faucent tool to get some xEGLD.

Use Devnet Maiar DEX to be a liquidity provider:

- Login with your wallet;

- Go to Swap tab;

- Swap 1 EGLD to USDC. Who provided the USDC for you to swap?

- Go to Liquidity tab;

- Add Liquidity: Use EGLD and USDC tokens;

- Perform several swaps;

- Remove Liquidity;

- Compare tokens in (provided when added liquidity) to tokens out (obtained when removed liquidity). If swaps were made in between, you should have gained some value from fees.